interest tax shield meaning

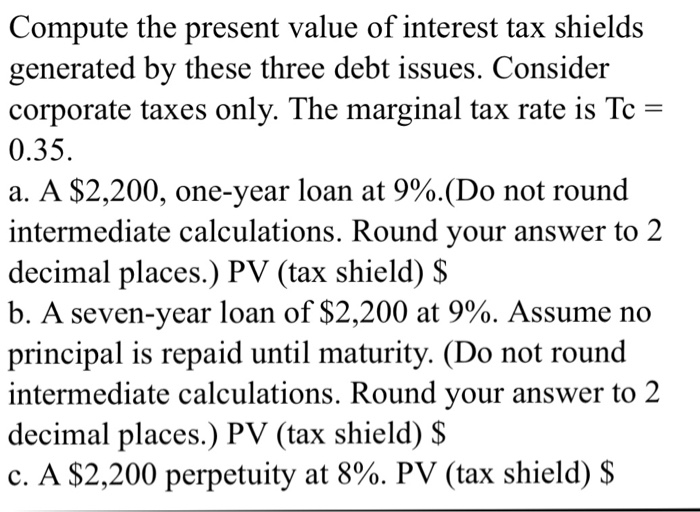

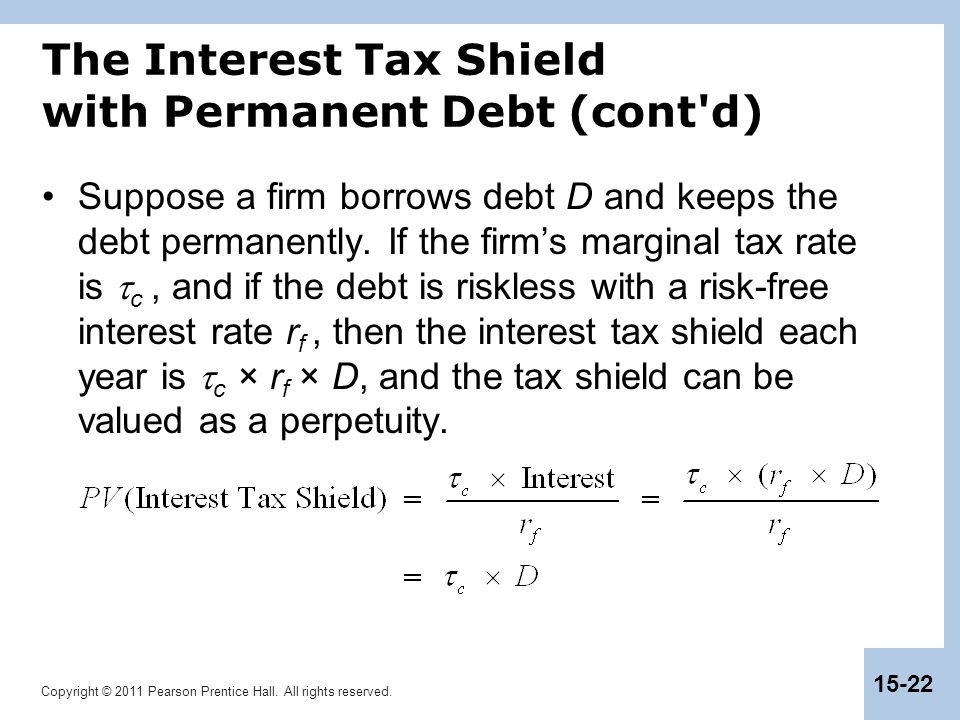

Interest expenses via loans. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

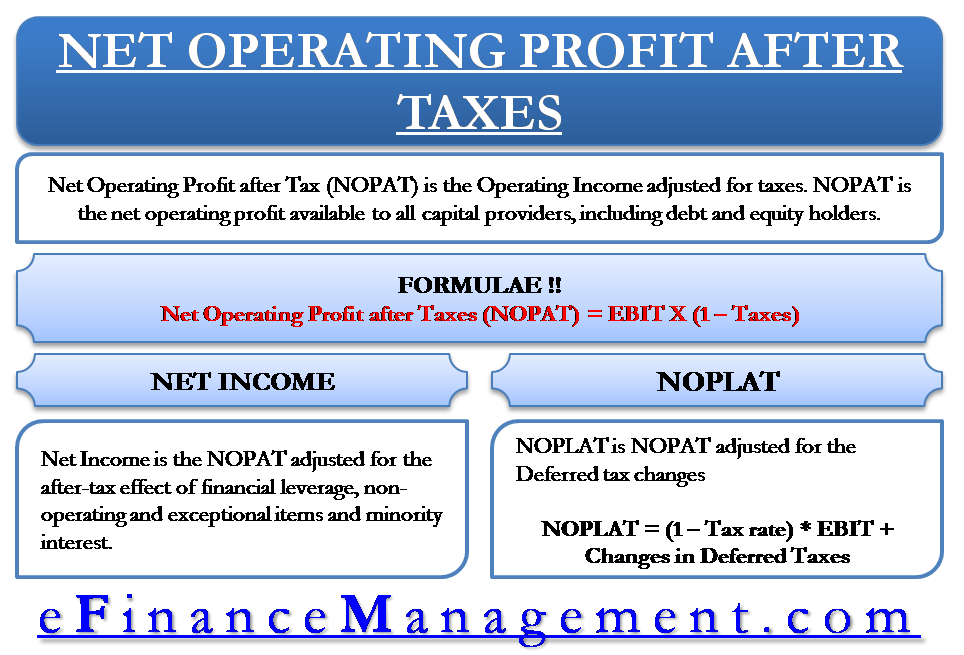

Net Operating Profit After Tax Efinancemanagement

For example a mortgage provides an interest tax.

. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation. Financial Definition of Interest Tax Shield. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

A tax shield is the deliberate use of taxable expenses to offset taxable income. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

A Tax Shield is the use of taxable expense that helps a business to lower its tax liability. Interest Tax Shield Interest Expense. The reduction of ones taxable income as the result of a properly qualified deduction.

Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula. Finance Meaning Read related entries on Financial Terminology I Finance Terms IN. The reduction in income taxes that results from the tax-deductibility of interest payments.

This is called a tax shield which is an allowable deduction from taxable income that saves you money on the tax bill. A tax shield refers to deductions taxpayers can take to lower their taxable income. Companies pay taxes on the income they generate.

The effect of a tax shield can be determined using a formula. This is usually the deduction multiplied by the tax rate. Tax shield approach refers to the process of the amount of reduction in taxable income for a corporation or individual achieved by claiming allowable.

A companys interest payments are tax deductible. Tax Shield Deduction x Tax Rate. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a.

As is hopefully clear by this stage the interest tax shield. This can lower the effective tax. Or we can say it is the reduction in the assessable income because of the use of.

Such a deductibility in tax is known as. An interest tax shield refers to the tax savings made by a company as a direct result of its debt interest payments. The intent of a tax shield is to defer or eliminate a tax liability.

Examples of tax shields include deductions for charitable contributions mortgage deductions. That is the interest expense paid by a company can be subject to tax deductions. Interest Tax Shield Author.

A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income. However issuing long-term debt accelerates interest. Interest expenses via loan.

A tax shield is a certain effect that occurs when. Examples of tax shields include mortgage interest deductions charitable donations and. If the expectations theory of interest rates holds firms pay the same present value of interest in the long run regardless of debt maturity.

Definition of tax shield. Companies pay taxes on the income they generate.

Risky Tax Shields And Risky Debt An Exploratory Study

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

What Is A Tax Shield Definition From Divestopedia

Solved Compute The Present Value Of Interest Tax Shields Chegg Com

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

Use Of Financial Leverage In Corporate Capital Structure

What Is The Depreciation Tax Shield The Ultimate Guide 2021

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Chapter 15 Debt And Taxes Ppt Download

Unlevered Free Cash Flow Definition Examples Formula

U Pv Interest Tax Shield Pdf Free Download

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

Private Equity Venture Capital True Partners Consulting

Interest Tax Shields Meaning Importance And More

Chapter 15 Debt And Taxes Ppt Download

The Trade Off Theory Of Capital Structure

Tax Shield Formula Step By Step Calculation With Examples

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury